Moon Mars SSP Earth Aliance

Canadian Bankers Association - Digital ID -Trudeau’s use of the Emergency Act

Sunlight is the best disinfectant. A promotional video from the Canadian Bankers Association (CBA) helps to neatly connect all the dots about why the Canadian government made such a quick reversal in their bank asset seizures in the last 24 hours {Go Deep}. And yes, as we suspected, it was almost certainly contact from the World Economic Forum to Canadian Finance Minister Chrystia Freeland that triggered the change in position.

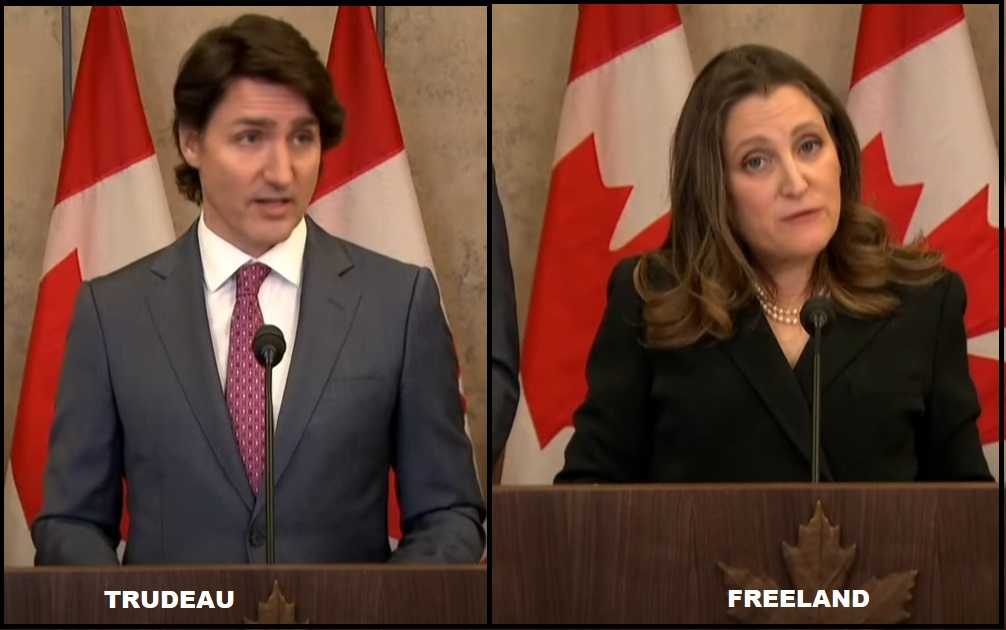

When Canadian Prime Minister Justin Trudeau and Finance Minister Chrystia Freeland announced they would use the Emergency Act declaration to target the financial support systems, banks and accounts of the people who were protesting against COVID mandates, they not only undermined the integrity of the Canadian banking system – but they also inadvertently stuck a wrench into the plans of the World Economic Forum and the collaborative use of the Canadian Bankers Association to create a digital id.

If the Canadian government can arbitrarily block citizen access to their banking institution without any due process, what does that say about the system the Canadian Banking Association (CBA) was putting into place as part of their Digital ID network?

If the CBA digital identity were in place, the same people targeted by Trudeau’s use of the Emergency Act would have their entire identity blocked by the same government measures. The realization of the issue, reflected by a severe undermining of faith in the banking system, is a dramatic problem for those working to create and promote the Digital ID.

It is not coincidental the financial targeting mechanism deployed by Trudeau/Freeland, the Canadian banking system, is the same system being used to create the digital identity. As a result of the government targeting bank accounts, Finance Minister Freeland just created a reference point for those who would argue against allowing the creation of a comprehensive digital identity.

The motive for the World Economic Forum and Canadian Bankers Association to immediately reach out to Trudeau and Freeland and tell them to back off their plan is crystal clear. THAT is almost certainly why Freeland appeared so admonished, shocked and incapable of getting her footing yesterday {Go Deep}, and why the Canadian government simultaneously informed Parliament they were unfreezing the bank accounts.

However, this undermined confidence and faith in the banking system cannot be restored quickly. The toothpaste cannot be put back into the tube. The horse has left the barn. This is now a moment for damage control by the Canadian government. That is why Justin Trudeau just dropped the declaration of the Emergency Act.

It all makes sense now. All of it.

Indeed, the government leaders who take their instructions from the multinational corporations in charge of the World Economic Forum, which is to say almost all of them, are so entrenched in their need to use COVID-19 as the pry bar for the Build Back Better agenda, they simply cannot let it go.

Without COVID-19, they can’t keep the vaccination push. Without the vaccination push, they can’t keep the vaccine passport process in place. Without the vaccination passport registration process to track and monitor human behavior, the governing authorities cannot fulfill the mission of a comprehensive digital identity and social credit tracking system. Indeed, everything they seek is contingent upon keeping the premise of COVID-19 alive.

It is not accidental the World Economic Forum is at the epicenter of this

As we previously noted, the architects of the Build Back Better society (WEF) are guiding various governments on ways to create efficient registration and compliance systems, i.e. ways that permit citizens to prove their vaccinated and compliant status. As these discussions are taking place, it is prudent to pause and think very carefully, wisely.

We all know, as we are reading this, under the guise of enhancing our safety, the U.S. Federal Government is in discussions with the medical community, multinational corporations and employers of citizens to create a more efficient process for you to register your vaccine compliance.

We know their conversation under the terminology of a COVID Passport. The current goal is to make a system for us to show and prove our authorized work status, which, as you know, is based on your obedience to a mandated vaccine.

Beta tests are being conducted in various nations, each with different perspectives and constitutional limitations, based on pesky archaic rules and laws that govern freedom.

For the western, or for lack of a better word ‘democratic‘ outlook, Australia, New Zealand, France and Europe are leading the way with their technological system of vaccination check points and registered state/national vaccination status tied to your registration identification.

New York City joined the vaccine checkpoint process, as their city now requires the vaccine to enter all private businesses. Los Angeles soon followed.

The Australian electronic checkpoints are essentially gateways where QR codes are being scanned from the cell phones of the compliant vaccinated citizen. Yes comrades, there’s an app for that.

Currently, the vaccine status scans are registered by happy compliance workers, greeters at the entry to the business or venue. Indeed, the Walmart greeter has a new gadget to scan your phone prior to allowing you custody of a shopping cart.

In restaurants, the host or hostess has a similar compliance scanner to check you in prior to seating or a reservation confirmation.

It’s simple and fun. You pull up your QR code on your cell phone (aka portable transponder and registration device), using the registration app, and your phone is scanned delivering a green check response to confirm your correct vaccination status and authorized entry.

The Australian government, at both a federal and state level, is working closely with Big Tech companies (thirsting for the national contract) to evaluate the best universal process that can be deployed nationwide.

As noted by all six Premiers in the states down under, hardware (scanners) and software (registration) systems are all being tested to find the most comprehensive/convenient portable units to settle upon. Meanwhile in the U.S., cities like Los Angeles and New York await the beta test conclusion before deploying their own version of the same process.

In Europe, they are also testing their vaccine checkpoint and registration processes known as the EU “Green Pass.”

The “Green Pass” is a similar technological system that gives a vaccinated and registered citizen access to all the venues and locations previously locked down while the COVID-19 virus was being mitigated. What would have been called a “vast right-wing conspiracy theory” 24 months ago, is now a COVID passport process well underway.

As with all things in our rapid technological era, you do not have to squint to see the horizon and accept that eventually this process will automate, and there will be a gadget or scanning gateway automatically granting you access without a person needing to stand there and scan each cell phone QR code individually.

The automated process just makes sense. You are well aware your cell phone already transmits an electronic beacon enabling your Uber or Lyft driver access to your location at the push of a touchscreen button, another convenient app on your phone. So, why wouldn’t the gateways just accept this same recognizable transmission as registration of your vaccine compliant arrival at the coffee shop?

The automated version is far easier and way cooler than having to reach into your pocket or purse and pulling up that pesky QR code on the screen. Smiles everyone, the partnership between Big Tech and Big Government is always there to make your transit more streamline and seamless. Heck, you won’t even notice the electronic receiver mounted at the entry. Give it a few weeks and you won’t remember the reason you were laughing at Alex Jones any more than you remember why you are taking off your shoes at the airport.

However, as this process is created, it is worth considering that you are being quietly changed from an individual person to a product. Some are starting to worry in the beta test:

[…] “you must become an object with attributes sitting in a database. Instead of roaming around anonymously making all sorts of transactions without the government’s knowledge, Australians find themselves passing through ‘gates’. …

All product-based systems have these gates to control the flow of stock and weed out errors. It is how computers see things. The more gates, the more clarity.

You are updating the government like a parcel pings Australia Post on its way to a customer. If a fault is found, automatic alerts are issued, and you are stopped from proceeding. In New South Wales, this comes in the form of a big red ‘X’ on the myGov vaccine passport app (if you managed to link your Medicare account without smashing the phone to bits).

Gate-keeping systems have been adapted from retail and transformed into human-based crowd solutions to micromanage millions of lives with the same ruthless efficiency as barcodes tracking stock. There is no nuance or humanity in this soulless digital age. Barcodes are binary. Good – bad. Citizen or dissident.

Even if you have all the required

government attributes to pass through the gates – two vaccines, six

boosters, and a lifelong subscription to Microsoft – something could go

wrong. If your data fails the scan, you’ll slip into digital purgatory

and become an error message. (read more)

It could be problematic if your status fails to register correctly, or if the system identifies some form of alternate lifestyle non-compliance that will block you from entry. Then again, that’s what beta tests are for, working out all these techno bugs and stuff. Not to worry…. move along….

Then again… “For those in the privileged class allowed to shop, take note of Covid signs which encourage cashless transactions under the guise of ‘health’. Messaging around cards being ‘safer’ will increase until the Treasury tries to remove cash entirely, almost certainly with public approval.”

Wait, now we are squinting at that familiar image on the horizon because we know those who control things have been talking about a cashless society for quite a while.

We also know that data is considered a major commodity all by itself. Why do you think every system you encounter in the modern era requires your phone number even when you are not registering for anything. It, meaning you, us, are all getting linked into this modern registration system that is defining our status. We also know that system operators buy and sell our registered status amid various retail and technology systems.

Yeah, that opaque shadow is getting a little clearer now.

Perhaps you attempt to purchase dog food and get denied entry into Pet Smart because you didn’t renew the car registration. Or perhaps you are blocked from entry because you forgot to change the oil on the leased vehicle you drive, and Toyota has this weird agreement with some retail consortium. You head to the oil change place that conveniently pops up in the citizen compliance App –it’s only two blocks away– they clear the alert after they do the oil change, and you are gateway compliant again.

Missed your booster shot? We’re sorry citizen, your bank account is frozen until your compliance is restored… please proceed to the nearest vaccination office as displayed conveniently on your cell phone screen to open access to all further gates (checkpoints)…. tap to continue!

Vote for the wrong candidate? Attend, or donate to, a trucker protest?

Yes, it seemed transparently obvious where this was heading, and Canadian Prime Minister Justin Trudeau just awakened the masses:

Link

http://theconservativetreehouse.com/blog/2022/02/23/boom-trudeau-reversal-motive-surfaces-canadian-banking-association-was-approved-by-world-economic-forum-to-lead-the-digital-id-creation/?fbclid=IwAR0xYS1TfqcCpHBqgwjFwiO4t6cVtBX1IzXAO_JsW4fSmJngdszO30bdTE8

The Effects of Seizing the Bank Accounts in Canada February 2022

Has there been a massive exodus of capital out of the Canadian financial system?

A few obscure but interesting data-points seem to indicate Justin Trudeau’s unprecedented use of the federal government and intelligence apparatus to target the bank accounts of Canadian citizens has just created a serious problem for their financial institutions.

If I was a betting person, I would bet half my stake that something very serious is happening in the background of the Canadian financial system, and it appears the leaders inside government, as well as leaders in the international financial community, are reacting and trying to keep things quiet. Stick with me on this and stay elevated…

BACKGROUND – When Prime Minister Justin Trudeau announced he was invoking the Emergency War Measures Act to seize bank accounts and block access to the financial system for people who were arbitrarily deemed as terrorists to the interest of the Canadian government, i.e. the Freedom Protest group writ large, many people immediately thought about the consequences of a government taking such action.

Indeed, the first response to many who witnessed the gleeful declarations of the Canadian government as they expressed their intent to utilize their emergency power, was that this was seriously going to undermine faith and confidence in the Canadian financial systems. The RCMP is the Canadian equivalent of the FBI.

If the government can work with the RCMP to target people based on an arbitrary political decree, and then control your bank account while simultaneously giving financial institutions liability protection for their participation, the confidence in the banking system is immediately undermined.

What might seem like a great tool for political punishment has long term consequences, especially if people start withdrawing their money and/or shifting the placement of their investments to more secure locations away from the reach of the Canadian government. Considering the rules of fractional banking and deposits, it doesn’t take many withdrawals before the banks have serious issues.

Has there been a massive exodus of capital out of the Canadian financial system?

A few obscure but interesting data-points seem to indicate Justin Trudeau’s unprecedented use of the federal government and intelligence apparatus to target the bank accounts of Canadian citizens has just created a serious problem for their financial institutions.

If I was a betting person, I would bet half my stake that something very serious is happening in the background of the Canadian financial system, and it appears the leaders inside government, as well as leaders in the international financial community, are reacting and trying to keep things quiet. Stick with me on this and stay elevated…

BACKGROUND – When Prime Minister Justin Trudeau announced he was invoking the Emergency War Measures Act to seize bank accounts and block access to the financial system for people who were arbitrarily deemed as terrorists to the interest of the Canadian government, i.e. the Freedom Protest group writ large, many people immediately thought about the consequences of a government taking such action.

Indeed, the first response to many who witnessed the gleeful declarations of the Canadian government as they expressed their intent to utilize their emergency power, was that this was seriously going to undermine faith and confidence in the Canadian financial systems. The RCMP is the Canadian equivalent of the FBI.

If the government can work with the RCMP to target people based on an arbitrary political decree, and then control your bank account while simultaneously giving financial institutions liability protection for their participation, the confidence in the banking system is immediately undermined.

What might seem like a great tool for political punishment has long term consequences, especially if people start withdrawing their money and/or shifting the placement of their investments to more secure locations away from the reach of the Canadian government. Considering the rules of fractional banking and deposits, it doesn’t take many withdrawals before the banks have serious issues.

His Deputy Prime Minister, Chrystia Freeland, is well known to people here for her prior key role in the creation of the USMCA trade agreement, her busybody demeanor and her snarky ideological annoyances. However, Chrystia is also the person who puts the words in Justin’s mouth, literally.

Watch a few seconds of this video from Trudeau’s statements about Ukraine yesterday and pay attention to the mannerisms of Freeland as the Canadian Prime Minister reads his prepared remarks. Watch her closely and what you will notice is that Freeland wrote the remarks. She is visibly saying them in her head while physically mirroring the exact cadence Trudeau uses as he delivers her script. WATCH:

https://youtu.be/lgB6iqOq4Jw

Watch that video from the perspective that someone in the international financial world, IMF, World Bank or other affiliate in the world of collective finance has just had a very serious talk with Finance Minister Chrystia Freeland.

♦ Shortly after that very awkward performance, Finance Minister Freeland’s assistant deputy, Isabelle Jacques, informed a parliamentary committee that all bank accounts frozen by the federal government’s use of the Emergency Act, were immediately being unfrozen.

( VIA CBC ) – […] More than 200 bank accounts worth nearly $8 million were frozen when the federal government used emergency powers to end a massive protest occupation of downtown Ottawa. Federal officials report most of the accounts are now in the process of being released, a parliamentary committee heard Tuesday.

Isabelle Jacques, assistant deputy minister of finance, told a committee of MPs that up to 210 bank accounts holding about $7.8 million were frozen under the financial measures contained in the Emergencies Act. (read more)

Obviously, many people realized from the outset what the Canadian government had done was tenuously legal at best, provided no legal due process or right of challenge, and likely would not pass any serious legal scrutiny. Unfortunately, in the echo chamber that is far-left liberalism, such matters are not as important as the ideological political motives; but there are people who realize the consequences of power-lust in this application.

Without a doubt, just as you were likely stunned, amazed and then angered by the financial punishment declared by Trudeau, there are people aligned with Trudeau –outside his government– who could see a bigger picture of consequence than those inside the echo chamber.

Justin Trudeau and Chrystia Freeland essentially broke the financial code of Omerta, by highlighting how easy it is for government to seize your bank accounts, credit cards, retirement accounts, insurance, mortgages, loan access and cut you off from money.

Worse yet, the short-sighted Canadian government via Minister Freeland announced their ability to control cryptocurrency exchanges in their country and block access within a financial mechanism that exists almost entirely as an insurance policy and hedge against the exact actions the government was taking.

♦ A very nervous Finance Minister, Chrystia Freeland, appears with Trudeau to talk about Ukraine.

♦ Freeland’s underling, Deputy Minister Jacques, is simultaneously telling parliament the bank accounts are being unfrozen.

♦ The CBC then reports that RCMP officials are taking a 180° reversal in position, about asset seizures.

Then there’s this supportive data-point from Jordan Peterson (Direct Rumble Link):

wef Chrystia Freeland

World Economic Forum Announces New Trustees

Adrian Monck, Managing Director, Head of Public Engagement, Tel. +41 (0)79 615 1671; adrian.monck@weforum.org

· Chrystia Freeland and Fabiola Gianotti join the World Economic Forum Board of Trustees

· The Board of Trustees serves as the guardian of the World Economic Forum’s mission and values

· For more information about the World Economic Forum, see www.weforum.org

Davos-Klosters, Switzerland, 25 January 2019 – The World Economic Forum announces that Chrystia Freeland, Minister of Foreign Affairs of Canada, and Fabiola Gianotti, Director-General of the European Organization for Nuclear Research (CERN), join its Board of Trustees. Their diverse backgrounds strengthen the multistakeholder governance approach to which the World Economic Forum is committed.

The Board of Trustees is the highest-level governance body of the World Economic Forum, the recognized International Organization for Public-Private Cooperation.

Chrystia Freeland began her career as a Ukraine-based news correspondent, and held senior positions at the Globe and Mail, the Financial Times and Thomson Reuters. She was first elected to the Canadian Parliament in November 2013 and was appointed International Trade Minister in November 2015, and Minister of Foreign Affairs of Canada in January 2017. She has written two books: Sale of the Century (2000) and Plutocrats (2012). In 2018, she was recognized as Foreign Policy’s Diplomat of the Year and received the Eric M. Warburg Award from Atlantik-Brücke. Freeland speaks Russian, Ukrainian, Italian, French and English.

Fabiola Gianotti has a PhD in experimental particle physics from the University of Milano, Italy. Since 1994, she has been a research physicist at CERN, the European laboratory for particle physics, where she led the ATLAS experiment at the time of the discovery of the Higgs particle. She is currently serving as CERN’s Director-General.

“The World Economic Forum, as the International Organization for Public-Private Cooperation, is delighted to welcome the new members of the Board of Trustees, strengthening the political and scientific experience,” said Klaus Schwab, Founder and Executive Chairman of the World Economic Forum.

As of 25 January 2018, the members of the Board of Trustees of the World Economic Forum are:

Klaus SCHWAB* Chairman of the Board of Trustees, World Economic Forum

Peter BRABECK-LETMATHE* Vice-Chairman, Board of Trustees, World Economic Forum; Chairman of the Board, Nestlé SA, Switzerland

H.M. Queen Rania AL ABDULLAH of the Hashemite Kingdom of Jordan

Mukesh AMBANI Chairman and Managing Director, Reliance Industries, India

Marc BENIOFF Chairman and Chief Executive Officer, Salesforce, USA

Mark CARNEY Chairman, Financial Stability Board; Governor of the Bank of England

Chrystia FREELAND Minister of Foreign Affairs of Canada

Orit GADIESH** Chairman, Bain & Company, USA

Fabiola GIANOTTI Director-General, European Organization for Nuclear Research (CERN, Geneva

Al GORE Vice-President of the United States (1993-2001); Chairman and Co-Founder, Generation Investment Management, USA

Herman GREF Chairman of the Board and Chief Executive Officer, Sberbank, Russian Federation

Angel GURRÍA Secretary-General, Organisation for Economic Co-operation and Development (OECD), Paris

André HOFFMANN Vice-Chairman, Roche, Germany

Christine LAGARDE Managing Director, International Monetary Fund, Washington DC

Ursula von der LEYEN Federal Minister of Defence of Germany

Yo-Yo MA Musician

Peter MAURER President, International Committee of the Red Cross (ICRC), Switzerland

Luis MORENO** President, Inter-American Development Bank, Washington DC

L. Rafael REIF President of Massachusetts Institute of Technology (MIT), USA

Jim Hagemann SNABE Member of the Board, SAP AG, Siemens AG, Allianz SE, Germany

Heizo TAKENAKA** Minister of State for Economic and Fiscal Policy of Japan (2002-2006)

Min ZHU* Deputy Managing Director, International Monetary Fund (2011-2016)

*Member of the Governing Board

**Member of the Audit & Risk Committee

Notes to editors

About the World Economic Forum: www.weforum.org

Access photo archive: http://wef.ch/pics

Become a Facebook fan: http://wef.ch/facebook

Follow us on Twitter: http://wef.ch/twitter and http://wef.ch/livetweet (hashtag #WEF)

Read our blogs: http://wef.ch/agenda

Follow us on Google+: http://wef.ch/gplus